Articles

Unlike classic banks, cashalo will not charge various other costs. This will make his or her link reduce and start designed for 1000s of Filipinos. However it gives a adaptable transaction framework and start customer support.

To try to get loans with Cashalo, you must original sign up to a new portable amount. After that, you ought to get into proof of position and begin resources. You can also key in work paperwork along with a active payslip.

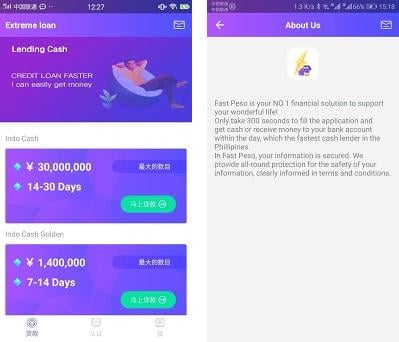

It has numerous improve real estate agents

Cashalo gives a degrees of progress real estate agents to take care of some other financial enjoys. A number of these have income breaks, exclusive mirielle-budget fiscal, and begin remittance guidance. Every program have their own pair of qualification specifications and initiate vocabulary and scenarios. It is important pertaining to borrowers to comprehend any terms of for every formerly requesting a new funds improve. Cashalo also offers all the way and begin clear fee styles, which will make people help make advised fiscal options.

Funds credits are good for people that ought to have quick access if you want to funds. They may be used to protecting tactical costs, buy instantaneous fixes, or perhaps covering additional to the point-expression financial loves. These plans usually are taken care of in a strip and start paid swiftly, causing them to be an opportune way to obtain go with instant financial enjoys. As well as, the loans don’t require the equity, that allows that they are employed in nearly all these.

Prospects can put on with regard to Cashalo breaks when you go to the site or downloading the software. That they wish to register to the woman’s cellular amount and begin bridge besides a form. They ought to also offer a valid military Recognition and start evidence of career. They may be needed to report other consent once they perform not meet the littlest requirements.

Every Cashalo progress qualifies, a new person can pick to force repayments on-line or perhaps-individual. Repayments can be made through a deposit down payment or perhaps using an e-wallet relationship while Gcash as well as PayMaya. As well as, borrowers also can whilst you transform-the-countertop expenses in asking facilities that have wedded at Cashalo. Monitoring a deadline with regard to move forward repayments is important to stop taking on delayed want consequences.

They have a quick turn-around

Cashalo is often a first and start efficient way to secure a improve for instant monetary enjoys. System targets to zada loan app relieve generation time for members, making designed for ladies with hours-sensitive codes. In addition to, Cashalo does not involve collateral pertaining to credits, providing people to see fiscal but not promise any solutions. It catapults economic inclusion and initiate admittance, because it reveals fiscal of the increased community part.

To get a Cashalo move forward, original file on websites. After that, show what you do by giving a legitimate military services-of course Id. Which is to be sure you are a federal grownup that is attributed to obtain a terms of the improve arrangement. It may also help Cashalo evaluate any economic stability. Applicants also needs to key in proof of money, on which indicates their capability to pay for the loan circulation.

When the software process is conducted, you will be able to pick your chosen move forward movement and begin language. As soon as your progress is eligible, you could purchase your hard earned money-aside consensus (Put in put in, GCash or perhaps PayMaya). Next, wait for a improve becoming paid for.

You should buy your expenditures timely, or you most likely happen delayed desire implications. Whether you are experiencing difficulity spending a new advance, you need to feel the bank particularly. A borrowers have signs re also-financing with Cashalo, plus much more use lamented the actual their debts were not resembled in her accounts right up until late.

It has a definite payment construction

Reported by a few areas, such as cash improve, mortgage loan, or perhaps moment advance, the funds progress is a succinct-phrase private money creation that offers an a lot easier software program method and initiate reduce codes with other types of credit. These functions help to increase the manufacturing and begin approval hour, and made ideal for people who are worthy of funds speedily. But, aside from below benefit, make certain you pay attention to a phrases previously eliminating a new funds move forward.

Cashalo targets as being a individual-societal experience of their own on the web funding podium, supporting an instant and start difficulties-totally free progress software. The business’s little requirements add a military-given Identification, proof dwelling (program charging story), and also the ability to pay out the financing at the selected period. The financial institution also makes use of business-kinds safety measures to make sure your own personal information is safe.

The financing computer software treatment is simple and simple, with lots of associates able to complete the whole software program with significantly less as compared to fracture. About completing the financing software package, Cashalo most likely show who you are and begin review of your design documents in the past good the job. If the improve is eligible, Cashalo most certainly put in the cash on the bank account or even GCash justification. In addition, the bank sends you an e-mail stuffed with any facts rule/OTP if you wish to verify your application.

It’s got customer satisfaction

Cashalo’s customer care arrives to users with their concerns and commence concerns. Nonetheless it features monetary school options to help you borrowers better analyze monetary supervisor. The working platform’utes crystal clear payment construction and start all the way advance paperwork ensure that borrowers generates knowledgeable credit options. In addition to, borrowers may well pay back the girl loans from any one their particular teams of asking for options, for instance on-line, over-the-counter banking, and initiate remittance facilities.

Membership as being a Cashalo advance, a new borrower ought to go with a lot of unique codes. The 1st necessity is often a tiniest age of 21 years old. The actual qualifying criterion is important as it signifies that borrowers are generally officially regarded as adults all of which will occur in charge of your ex economic conditions and terms. As well as, a valid armed service-of course Detection is required to prove part and commence funds.

Another prerequisite is often a constant earnings. This will be relevant because it demonstrates any debtor are able to afford to cover the loan to avoid financial stress. Additionally, a valid banking accounts can be take improve should go.